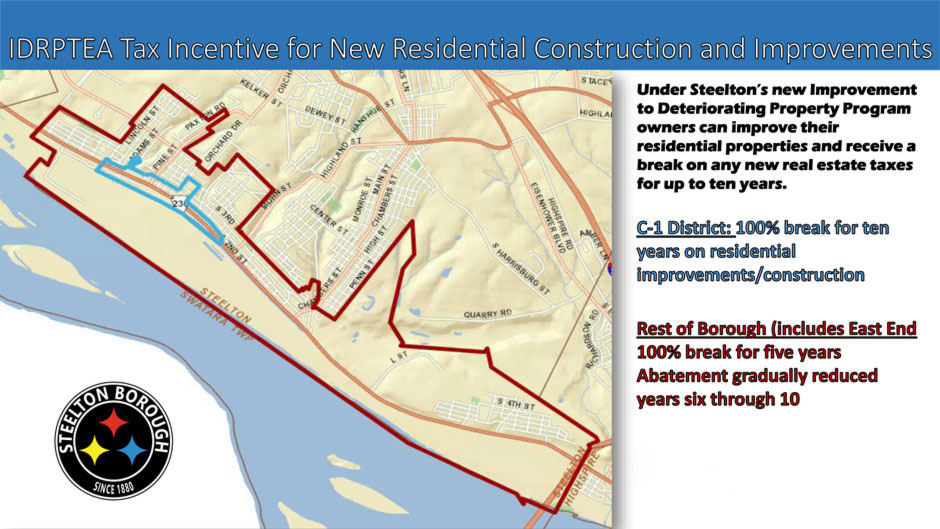

IDRPTEA (Residential Tax Incentive)

The Improvement to Deteriorating Real Property Tax Exemption Act passed by the Pennsylvania Legislature, and Ordinance 2017-03 passed by the Steelton Borough Council, is a creative way to encourage owner-driven revitalization and new construction in Steelton Borough. Residential properties that qualify for IDRPTEA still pay real estate taxes on the currently assessed value of their property, but receive a break on any new real estate taxes of up to 100% for ten years. By not immediately taxing the property owner on improvements made, Steelton Borough grants them the opportunity to recuperate the money used for residential home improvements or new residential construction.

The Steelton IDRPTEA program provides new and existing property owners in the C-1 Town Center Commercial District with a ten year, 100% break on new real estate taxes that result from new construction or renovations to existing residential properties.

Property owners in the Non-C-1 District receive a similar break on new real estate taxes on new construction/improvements on the following schedule:

- 100% break on new real estate taxes years 1 through 5

- 80% break on new real estate taxes year 6

- 60% break on new real estate taxes year 7

- 40% break on new real estate taxes year 8

- 20% break on new real estate taxes year 9

- Pay the full amount of taxes on improved property in year 10.

The IDRPTEA abatement does NOT make a property tax free. It only applies to new real estate taxes that result from increased property value.

COMPLETE and SUBMIT an IDRPTEA Tax Abatement Application to the Steelton Borough Codes Office PRIOR to the start of construction. A copy of the exemption request shall then be forwarded to all three local taxing authorities for consideration (Steelton Borough, Steelton-Highspire School District, and Dauphin County). Each local assessment agency shall, after the completion of the new construction or improvement, consider separately the new construction or improvement of approved properties and calculate the amounts of the assessment eligible for tax exemption according to limits established by the local authority. The taxpayer and local taxing authorities will then be notified of the reassessment and amounts of the assessment eligible for exemption under IDRPTEA program.

Improvements that do not result in an increased assessed value on subject property will not qualify for the IDRPTEA abatement.

*IDRPTEA will only be granted when an application accompanies a building or use registration permit; benefits WILL NOT be applied retroactively to projects started without proper permits.